IP Portfolio Management

A Value Based IP Management Approach (VIPM)

It is well known that the value distribution of a portfolio comprising intangible assets follows a lognormal curve. That is, only 10% of your IP portfolio make up 90% of the portfolio’s value. In other words, 90% of your IP portfolio only makes a minor contribution to the IP portfolio’s overall value.

The question is how to manage your portfolio in order to significantly increase the portion of high value assets beyond the 10% statistical value.

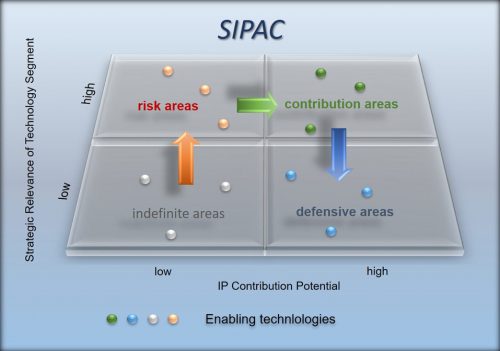

For achieving this we developed and successfully implemented a value based IP management approach. The SIPAC-Method (Strategic IP Asset Creation) evaluates innovations according to IP value components and selects the high value innovations to finally turn them into IP assets. Besides the strategic relevance of an innovation we also consider the IP contribution potential of the organisation. This way we guarantee that your portfolio development plan is not built on wishful thinking but also takes into account the available skills and budget of your enterprise.

Active portfolio development is targeting to turn risk areas with a low IP contribution potential into areas with a high contribution potential over time. Of course, this requires your innovation functions to consider IP strategic considerations for your technology roadmap.

Our approach allows you to significantly increase the probability for creating high value IP assets in those fields which are of strategic importance to your enterprise. Thus, over time the value based approach will also increase the value of your overall IP portfolio.